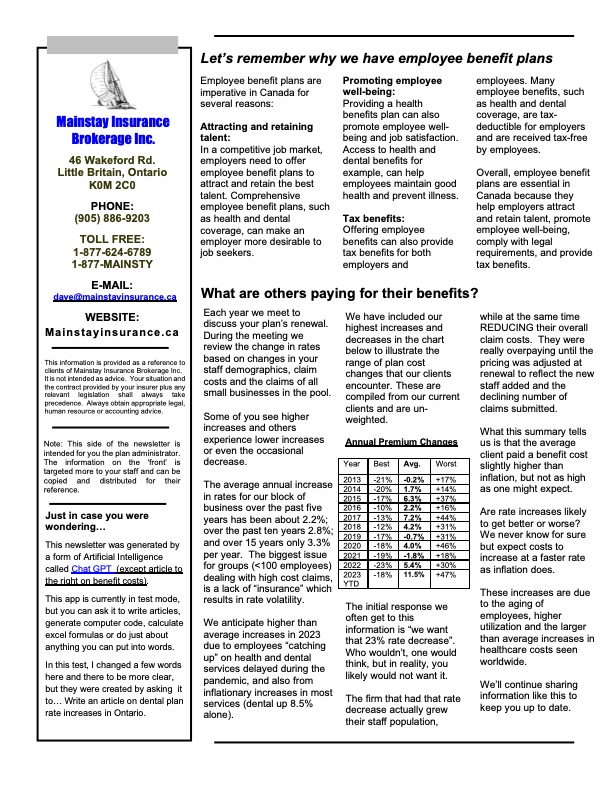

Year: 2023

Webinar – Thursday June 29th, 2023 from 1-2pm

As a member of CFIB, I often get e-mails about the products and service they offer small business. This one caught my eye and thought it might be of interest to clients. It appears that non-members can attend by using GUEST at the registration as noted.

If you are interested but can’t attend? Register and you’ll receive a link to the recorded webinar.

Employee Management Series 1: Hiring? Let us help you get started.

As an employer, one of your many roles is finding the right people for your business. In this multi-part series, we’ll begin by exploring the hiring process.

Join us for this important session and learn how to best position yourself in this tight labour market:

– Learn the value of a clear and compelling job ad and how to create a competitive compensation package that candidates want.

– Discover where to post your ad to best connect you with candidates.

– Learn how to think outside the box to access a larger labour pool.

– Choose the best candidate to fit your needs and learn why a solid employment contract is a must.

Thursday, June 29, 2023 1pm – 2pm ET (10am – 11am PT)

Register now

Disability Accommodation In The Workplace: What Are Your Responsibilities As An Employer? (Video)

As an employer, you have a legal obligation to accommodate employees with disabilities.

This webinar walks you through what constitutes a disability, as well as best practices for handling accommodation requests.

Topics will include:

- What medical information may an employer request

- How to communicate with employees regarding disability accommodation

- Can an employer ever prove undue hardship

Our panel of Employment Labour & Equalities Law professionals answer these questions, and provide insight into how you can create a safe, accommodating environment in your workplace.

Cost of employer medical benefits forecast to rise 7.5 per cent in 2023

We’ve seen client rate increases be higher in 2023 than we’ve seen in decades and higher than I’ve seen in the 17 years I’ve been tracking and sharing on my website.

With drugs trending up about 6.3%, dental fee guides (in Ontario) up 8.5%, the aging effect on pooled benefits (life and LTD) at 8% or more, it’s really no wonder. Add in the fact that many people are still playing catch up on getting work done (dental, vision and parameds), that was delayed due to the pandemic, and it was almost expected. The article below (from January) identified this before the year even started.

Most clients are glad to see staff making use of the plans. Many are increasing their core benefit offerings, some are adding Health Spending Accounts (HSA’s) and others are increasing existing HSA’s to keep up with inflation. If times are tight and you’re looking to trim costs, or are interested in looking at cost effective ways to enhance plans, please reach out.

The cost of employer medical benefits in Canada are forecast to rise 7.5 per cent in 2023, according to the 2023 Global Medical Trend Rates report from Aon plc.

“As employer-sponsored medical plans become an ever-increasing part of an organization’s employee compensation, pressure is growing to accurately forecast and manage future costs,” the firm states in its announcement about the report’s publication. “Employers need to understand the factors driving costs to better navigate volatility and make more informed decisions.” They add that the rates discussed are not meant to represent healthcare costs as a whole.

The global average medical trend rate for 2023 is expected to be 9.2 per cent, the highest trend rate recorded since 2015. In 2022 the global average sat at 7.4 per cent in 2022.

In Canada, the annual medical trend rate was seven per cent in 2022, rising to 7.5 per cent in 2023.

Business owners brace for second stage of CPP expansion

I was not aware that the CPP premiums employers pay have risen so much (this and next year), This is a result of the federal governments 2016 announcement to enhance CPP benefits. The change is intended assist those unprepared for retirement and without access to a workplace pension.

In 2023, employers are paying 44.7% more at the top end than in 2018

Business-owner clients struggling to absorb the cost of rising Canada Pension Plan (CPP) payroll contributions over the past five years will get little relief when the second stage of CPP expansion begins in 2024.

Establishing a Working From Home Policy

During the pandemic (and since), we’ve had many of our clients move to remote working arrangements. On a one to one basis we’ve discussed many of the problems of employees working out of the province/country. From losing provincial health coverage, to benefit eligibility failing, to tax and residency issues, employers really need to do their homework before allowing employees to work out of Canada.

For employees working remotely within the province, there are still many considerations that could be covered through a well worded policy. The article below has a good checklist of sorts that you may find useful.

Aird & Berlis LLP’s Workplace Law Group recently presented a webinar entitled Work From Home: The New Normal? which focused on the continuation of work-from-home (“WFH“) arrangements beyond the COVID-19 pandemic, remote work policies and key considerations for employers when administering such arrangements.

In this bulletin, we address some of the major themes set out in the questions.

The following list sets out the essential elements of a WFH policy:

No need to make plan changes due to EI changes (for most clients)

We have published blog posts on the change in Employment Insurance (EI) extension from 4 to 6 months that took effect at the end of 2022, as well as an article in our newsletter, but wanted to close the loop as there has been questions from clients.

Our advice is to keep all plans STATUS QUO and make no changes. Here’s why…

- Clients that have no Short Term Disability (STD or WI) or Long Term Disability (LTD) need not do a thing. The EI sick benefit provided by the federal government has now been extended to 6 months and their staff will benefit from that. STATUS QUO

- Clients that have an LTD plan with a 120 day waiting period, should keep it as-is, even with the EI sick benefit extending to 180 days. Here’s why…

- Delaying employees benefit payment in the case of disability, creates a financial hardship for those claiming due to 2 more months at a reduced, taxable EI benefit, until LTD so stay STATUS QUO

- Employers that have SUBP plans (that top up EI sick benefits) would incur much higher costs for their top up (as 50% longer) so stay STATUS QUO

- Employees are better served by early intervention by insurers. This can help with earlier return to work accommodations and less malingering, so stay STATUS QUO

- Some insurers are actually increasing LTD rates due to a lack of early intervention. Rates are high enough so stay STATUS QUO

The one caveat to all of this staying STATUS QUO is that the employee needs to stop the EI benefit at 120 days in order to get the higher LTD benefit (without double dipping). Only they can do so, and most insurers have told us they will remind the employee (to stop the EI claim) when the LTD claim is approved. Even if the disabled employee forgot and collected both EI and LTD benefits for the 2 months (overlapping), they would only have to pay back the EI benefit (which is less than the LTD benefit payable, so no financial issue).

If you or an employee has any questions, please do not hesitate to reach out.

Pay Transparency Legislation in Canada

Pay transparency legislation is not in Ontario (YET), but it is working its way into law in Prince Edward Island, Nova Scotia, British Columbia, Newfoundland & Labrador.

Generally this legislation prohibits an employer from asking about a prospective hires wage history. The article provides more below, but be aware as this may affect you if hiring remote workers in other provinces…

Pay transparency became the topic of much discussion when the province of Ontario tabled legislation in 2018. While this legislation never came into effect (still to this day) other provinces have enacted pay transparency laws and others are considering doing so.