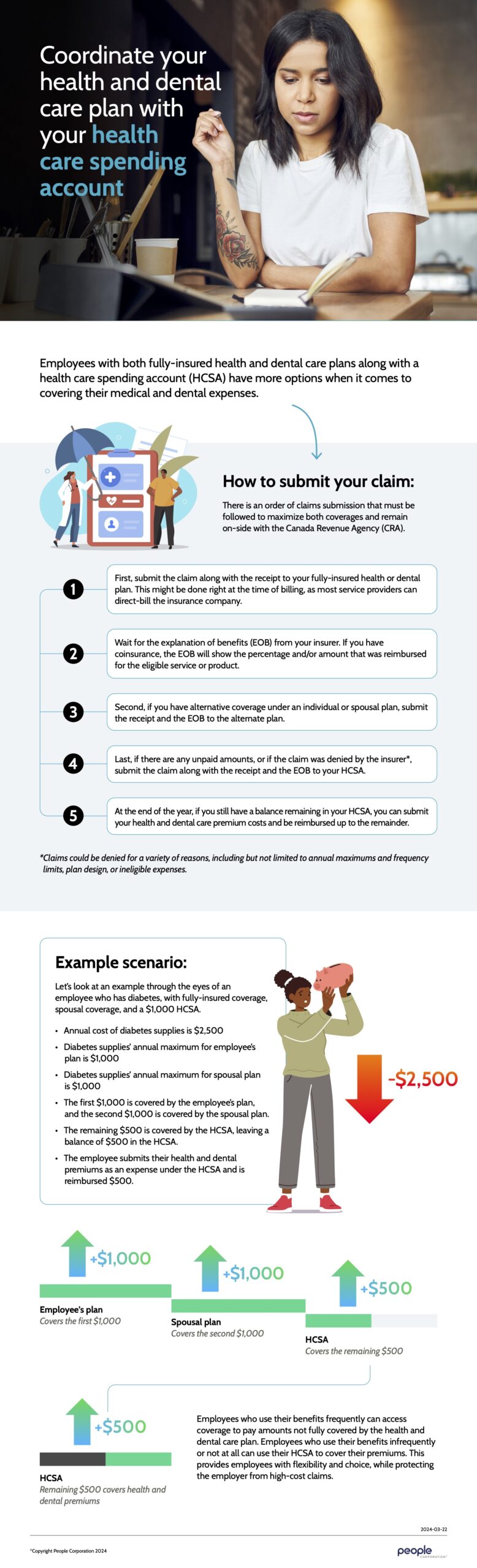

We have more and more clients using HealthCare Spending Accounts (HSA or HCSA) each year. This is a valuable benefit which has lower administrative costs than traditional benefits, and provides great flexibility to employees and their families.

In order to ensure your employees HSA is best utilized, it makes sense to coordinate usage with spousal benefit plans. (If you are single, or don’t have spousal benefits, you can ignore this post). The document below provides a simple example of how this process works. Depending on the provider (insurer or TPA) you use, claims may be handled in slightly different manners, but the general order of operations shown below apply.

If you’re interested in adding an HSA to your plan, or have one and would like to increase your HSA annual limit, let us know and we can make it happen. Most plans work on the calendar year, so there is lots of time to discuss before make changes for 2025. Starting an HSA can be done at almost any time.