Many clients have had high cost drug claims affect their plans. I define these as over $10,000/year, with many now costing in the hundreds of thousands of dollars per year (and often for a lifetime). We have a number of ways of handling these claims from the limited protection of pooling on insured plans, to more extreme measures such as drug caps and exclusionary formularies that push the cost from the employer and employee’s pocket, to the province or patient assistance program.

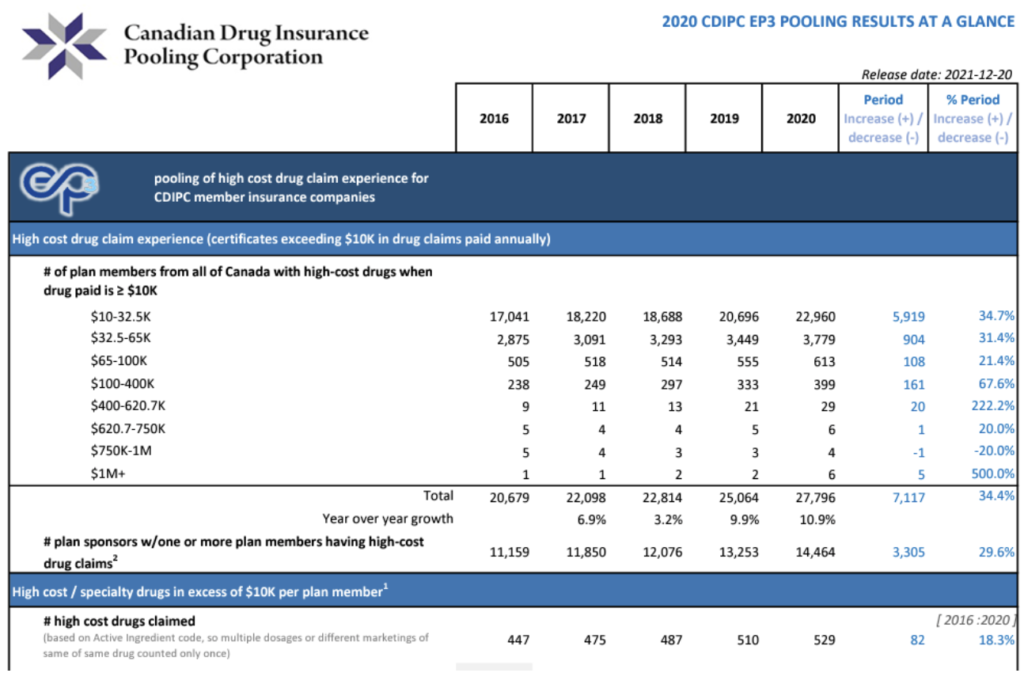

The Canadian Drug Insurance Pooling Corp. (CDIPC) issues a report each year as to the number and breakdown of these claims. I’ve clipped a small part of the report below to illustrate the number and cost of claims, and how they have increased in the past 5 years.

There are 26 million Canadians covered by supplementary health insurance coverage (90% is group plans & 10% individual coverage). There were almost 28,000 drug claims over $10,000 in 2020 (report clip below). This equates to about 1 high cost claim for every 930 people. Because group plans cover spouses and dependent children, we could extrapolate that there are 2.9 people per family (StatsCan), which means that there will be one high cost claim for every 320 employees.

I’m not trying to scare people by saying “the sky is falling”, but I do want people to be aware that these are no longer “rare” drugs and in fact, many of them are mainstream treatments with some being the drug of choice in treating new patients. Click on the report below if you’d like to see the entire document, or call us if you have questions.